|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dog Insurance in Georgia: Navigating the Canine Care LandscapeIn the charming state of Georgia, known for its lush landscapes and warm Southern hospitality, a growing number of dog owners are starting to consider the benefits of dog insurance. As any pet owner will tell you, the joy of having a furry companion is often accompanied by the responsibility of ensuring their health and well-being. While the concept of pet insurance might still be novel to some, it's gaining traction as more people recognize the potential financial relief it can provide. Dog insurance in Georgia, much like in other parts of the United States, offers a range of coverage options that can be both comprehensive and specific. The idea is to mitigate the unexpected costs of veterinary care, which can sometimes be surprisingly high. When pondering whether to invest in dog insurance, several factors come into play that deserve careful consideration. First, it's essential to understand the types of coverage available. Most policies generally offer accident-only coverage, which might be suitable for the more adventurous pups prone to getting into scrapes, or comprehensive coverage that includes accidents, illnesses, and sometimes even wellness visits. It's crucial to thoroughly examine what each plan covers and identify any exclusions or limitations.

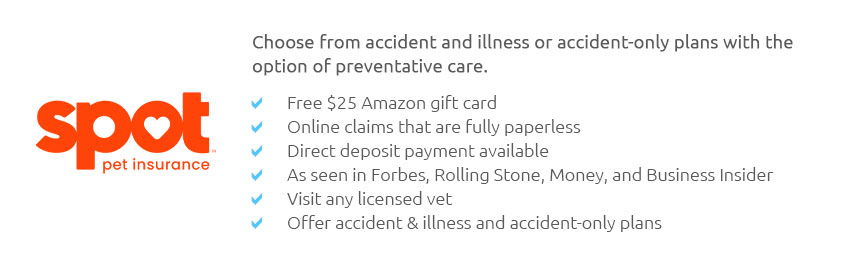

The cultural landscape of Georgia, with its mix of urban and rural communities, plays a role in how dog insurance is perceived and utilized. Urban areas like Atlanta may have more readily available veterinary specialists and clinics, whereas rural areas might rely on fewer resources, making comprehensive insurance more appealing. Moreover, the sense of community often found in Georgian towns can influence decisions, with neighbors and local vets often recommending specific insurance plans based on collective experiences. Ultimately, the decision to purchase dog insurance is a personal one, influenced by the unique circumstances and values of the pet owner. While some may see it as an unnecessary expense, others view it as a prudent investment in their pet's health and their peace of mind. In a world where the unexpected can and does happen, having a plan in place can be a wise move. In conclusion, as the popularity of dog insurance continues to grow in Georgia, it is vital for pet owners to conduct thorough research and consider their specific needs and circumstances. Whether it's to safeguard against the high costs of emergency care or to ensure a comprehensive wellness plan for their beloved canine, dog insurance can offer a layer of security that aligns well with the caring and protective nature of pet ownership. https://spotpet.com/locations/georgia

Spot plans cover accidents and injuries like broken bones or fractures that may result from an encounter with a wild animal. https://www.metlifepetinsurance.com/state/georgia/

MetLife Pet Makes Pet Insurance in Georgia Easy. Easy Enrollment & Same-Day CoverageNo initial exam or previous vet records required. Plus get a 0-day waiting ... https://www.lemonade.com/pet/explained/georgia-pet-insurance-guide/

eligible accidents and illnesses. Here are some common types of care that Lemonade pet insurance ...

|